Effective July 1, 2026, many currently mandatory automobile accident benefits will become optional. These benefits are available regardless of who caused the accident and can cover things like medical treatment, rehabilitation and income if you can’t work because of your injuries.

Standard medical, rehabilitation and attendant care benefits will continue to be mandatory. These benefits cover medical expenses, therapy, and personal care assistance for injuries from an accident including doctor visits, physiotherapy, and help with daily activities like bathing and dressing.

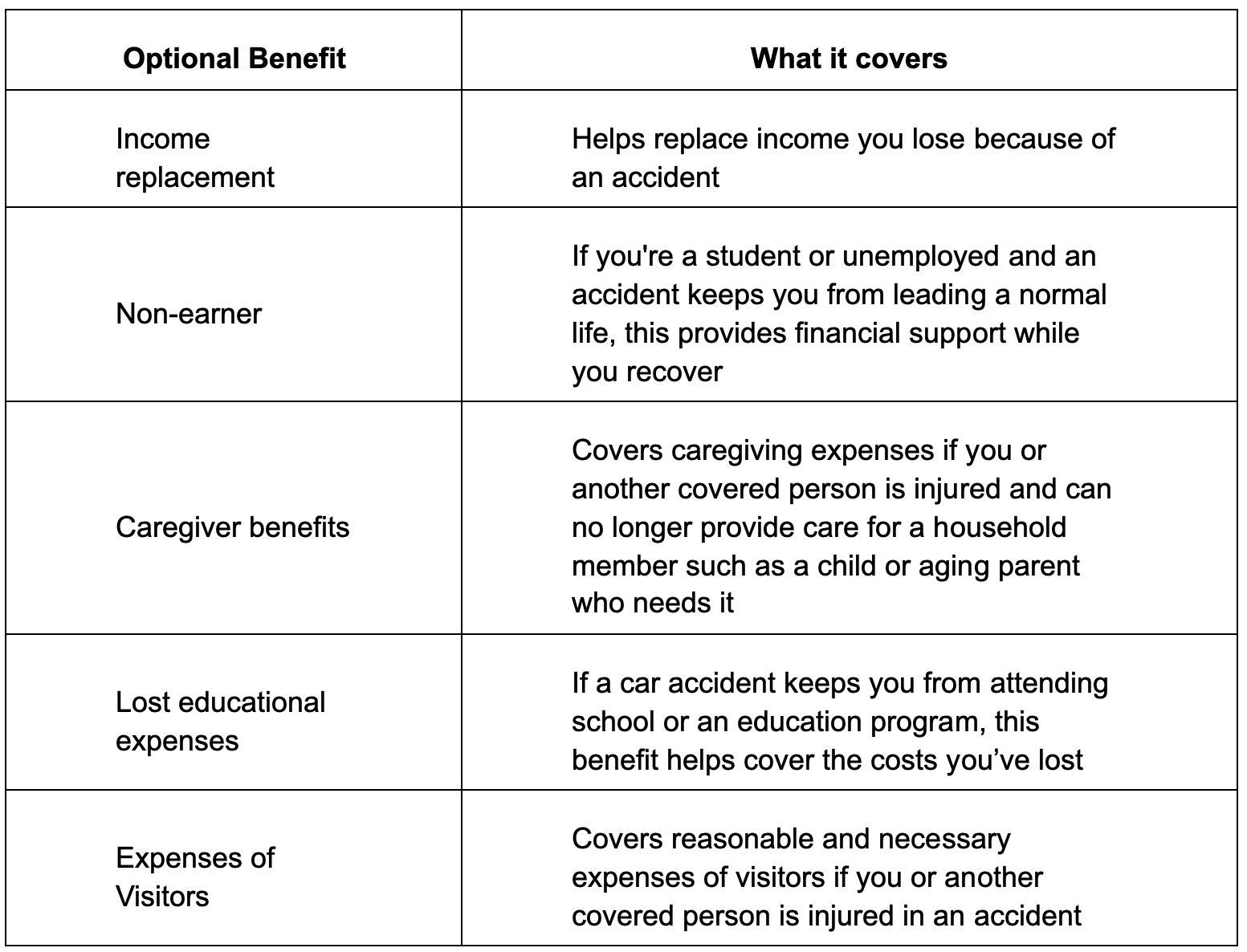

The following chart describes the benefits that will become optional on July 1, 2026. If a driver chooses not to have the following optional coverage, then the benefits will no longer be available in the event of an automobile accident.

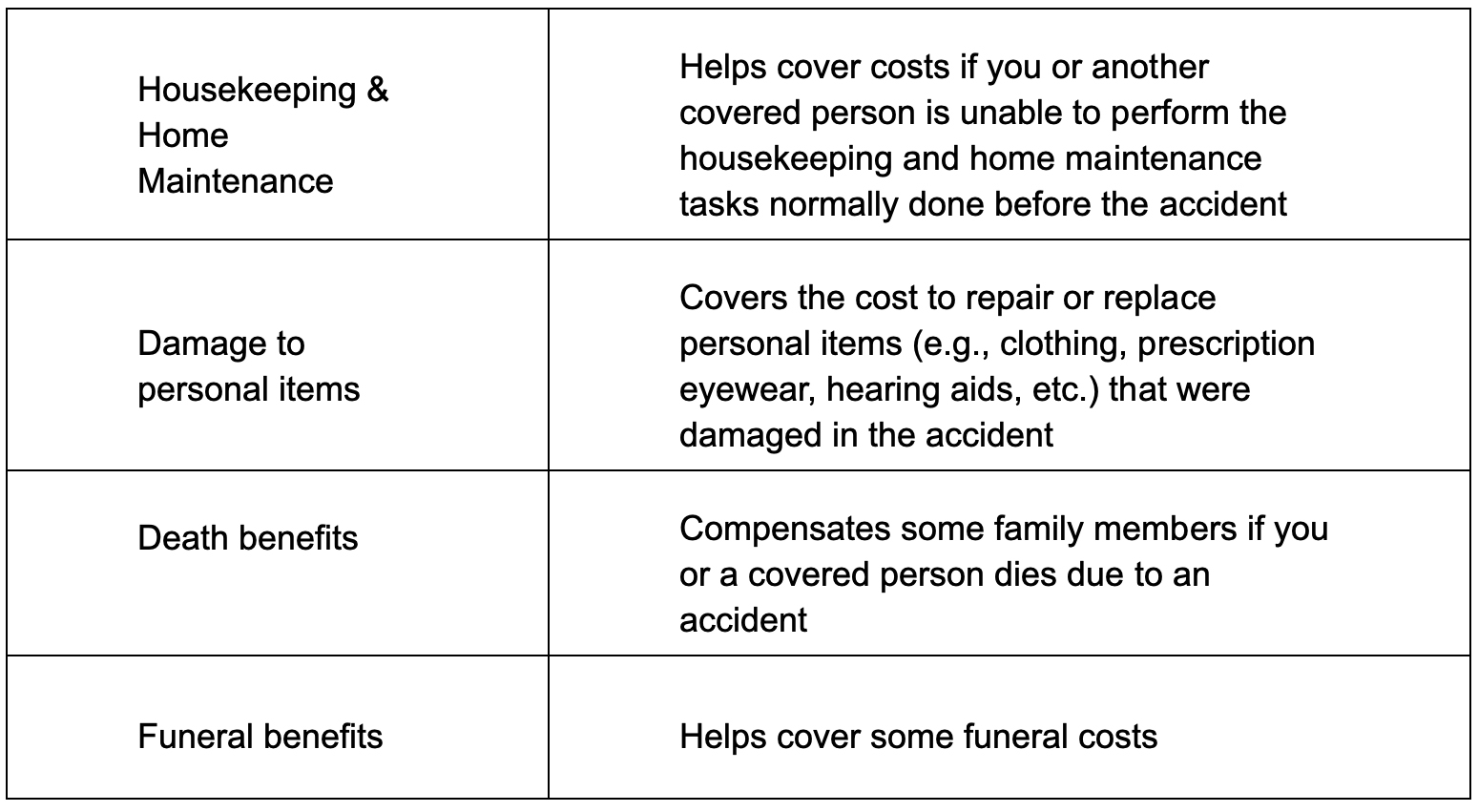

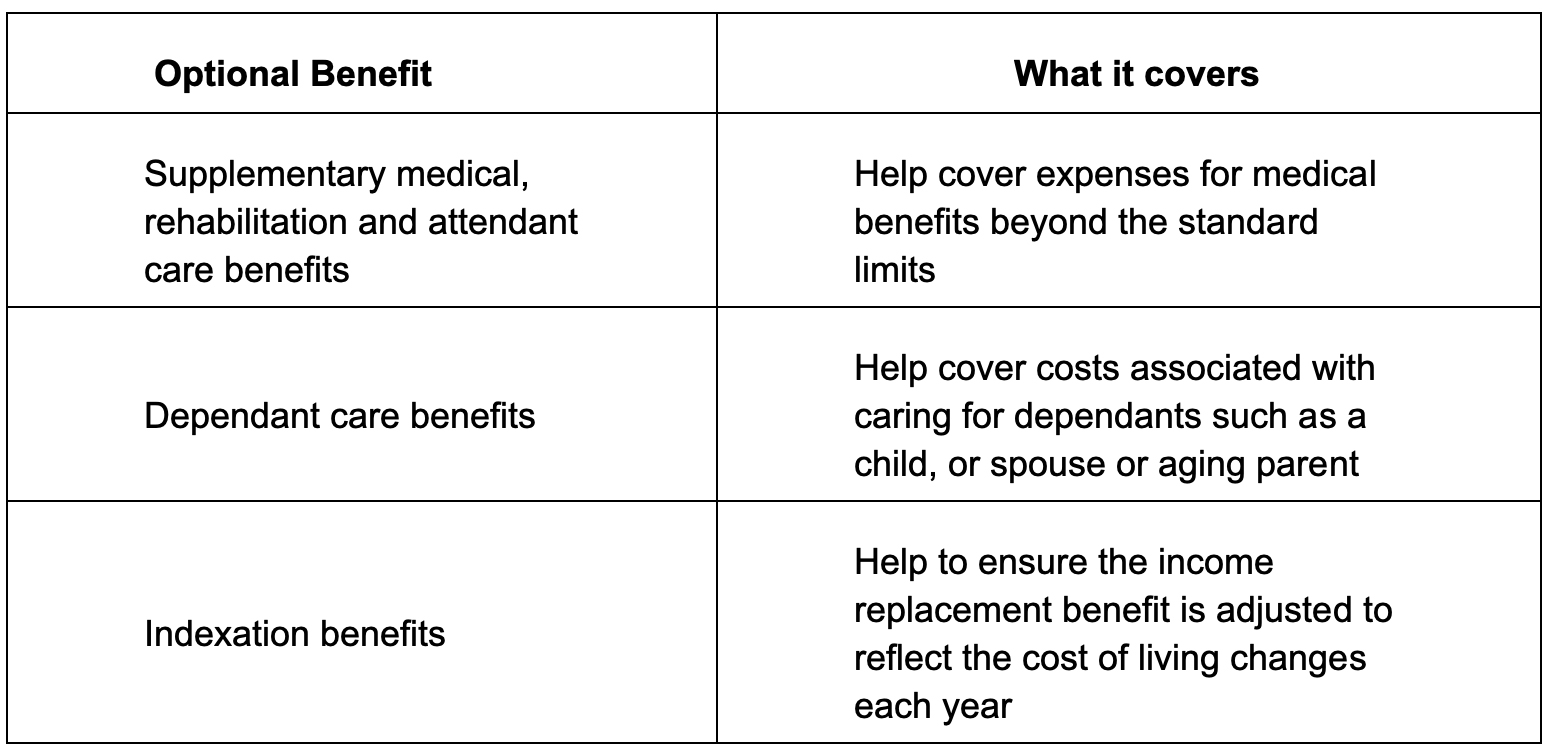

In addition to these soon to be optional benefits, the following optional benefits remain available to drivers:

Automobile insurers will become the first payer when an accident happens. Claimants will no longer be required to exhaust other available benefits first. However, optional coverage will apply only to the named insured, their spouse and dependants, and other individuals specified in the insurance policy as drivers.

Drivers should review their current automobile insurance policy and any other relevant coverage – such as from work or from private life or health insurance – to determine the benefits currently available to them. Drivers should then consider their own situation, and which optional coverage is needed after July 1, 2026.

Most importantly, drivers must understand that opting in to optional accident benefits is essential to maintaining meaningful protection after July 1, 2026. If no action is taken, existing coverage will generally carry forward at renewal, but any future changes or reductions could permanently limit access to accident benefits.

If you or a loved one is injured in a motor vehicle accident, the availability of accident benefits can make a critical difference in recovery and financial security. With these major changes approaching, now is the time to act.

We encourage drivers to speak with their insurance broker to fully understand their coverage options and ensure they have opted in to the benefits they may need. If you have questions about accident benefits, coverage disputes, or your rights after a collision, our team is here to help. Contact us today for a consultation to make sure you are protected before an accident happens, not after.